Oil prices, the dollar, sanctions, trade tensions, trips to the International Monetary Fund and shock election results.

Take your pick and financial markets felt turbulence this week with ramifications for the world economy.

Emerging markets face the biggest test and that’s the central theme in our weekly wrap-up of what’s going on in the world economy.

Iran and Oil

U.S. President Donald Trump’s announcement to pull out of the Obama-era deal and reinstate sanctions on Iran sent ripples through markets, pushing oil further above $70 a barrel. Minimizing the economic damage will be key to the country’s efforts to ensure domestic stability. $200 billion in potential energy deals for Iran now hang in the balance. Higher crude prices will likely hit economies elsewhere.

Emerging Markets

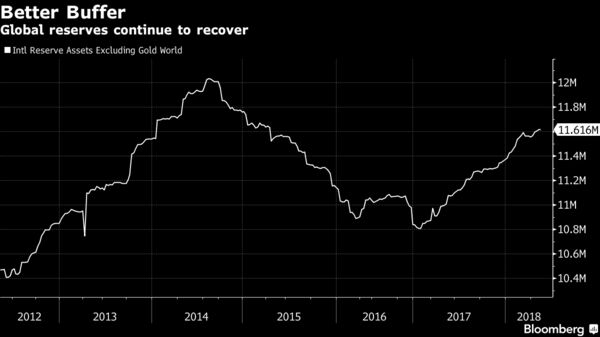

Emerging markets are facing perhaps their biggest stress test since the Federal Reserve’s 2013 “taper tantrum” episode. Currency volatility and capital flows are among the worries on the horizon in Asia, while central banks across emerging markets are being put on the spot to manage fresh stresses, particularly in India. Almost two dozen key EMs will decide on interest rates over the next two weeks, but Federal Reserve chief Jerome Powell says he’s confident these markets can handle policy normalization in advanced economies.

Read More:

- Modi Orders Team to Do Math on New Jobs to Showcase Success

- Fed Study Shows U.S. Hikes Hit High-CPI Emerging Markets Hardest

- Scoreboard for Emerging Markets as Trump Hits Oil, Trade: Chart

U.S., China, and U.S.-China

Ongoing drama between the world’s two biggest economies kept up momentum, even as China seemed to soften its tone on trade over the weekend after the Trump team went home without much progress to report from meetings. A reported Trump-Xi phone call Tuesday previewed a top Chinese economic official’s visit next week to Washington. There was less harmony in Geneva, where the two powers were clashed at a World Trade Organization gathering. Nafta negotiators continue to struggle on a revised deal.

Read More: